Published:

Picture this: you’re legally living and working from a sun-drenched cafe in Lisbon or a quiet mountain town in Costa Rica. That’s the new reality made possible by digital nomad visas, a special kind of long-stay permit designed from the ground up for remote workers. This guide will walk you through everything you need to know about these visas.

Unlike a typical tourist visa, which almost always forbids you from earning an income, these programs let you settle in for a year or even longer. All the while, you can work for clients or employers back home.

Why Digital Nomad Visas Are Booming Worldwide

The whole concept of a digital nomad visa really took off after the global shift to remote work. Countries quickly saw an opportunity to attract skilled, independent professionals. These remote workers could add to the local economy without taking local jobs. What followed was a friendly competition, with dozens of nations now offering attractive programs to woo us location-independent folks.

This shift is much more than just a legal workaround. It’s a powerful enabler for a slower, more sustainable way to travel. Instead of frantic, short-haul trips that rack up your carbon footprint, you can set down temporary roots. This opens the door to deeper cultural immersion. Plus, it fosters a real connection to the community you’re calling home for a while.

The global digital nomad population has exploded. Consequently, over 50 countries now have specialized programs. This lifestyle, blending remote work with immersive travel, injects serious cash into local economies. In fact, nomads tend to spend more than the average tourist during their longer stays. Europe is leading the charge with over 20 different programs. For a closer look at the data, Deel’s comprehensive report on remote work visas is a great resource.

Why This Matters for Sustainable Travel

For eco-conscious remote workers, these visas are a total game-changer. They provide the legal foundation for a low-impact lifestyle. Specifically, one built around rail travel and settling into walkable cities.

- Less Flying, More Living: By staying in one place for a year, you drastically cut down on long-haul flights. These flights are a massive source of travel-related carbon emissions.

- Real Local Support: Your long-term spending on housing, food from the local market, and neighborhood services directly supports small businesses. This is something short-term tourism just can’t match.

- Deeper Connections: A longer stay gives you the time to actually learn local customs. You can also support sustainable initiatives and build genuine relationships. It fosters a much more respectful way to travel.

Choosing one of these visa-friendly locations means you can join a community that values both professional freedom and a more thoughtful approach to seeing the world. To get started, check out our guide on the top 10 sustainable digital nomad destinations for 2025. It’s the perfect next step to finding a visa that truly aligns with your career and lifestyle goals.

Top Digital Nomad Visas for a Sustainable Lifestyle

So, you’re ready to pick a home base. This is the moment when all the legal talk about digital nomad visas turns into the real adventure of setting down roots in a new country. We’re going to walk through some of the best programs out there today. However, we’ll use a specific lens: finding a home that supports a sustainable, slow-travel mindset.

We’ll look past the basic income numbers. Instead, we’ll focus on countries that have incredible public transport, truly walkable cities, and a genuine commitment to green initiatives. Think of this as your shortlist for a visa. A visa that doesn’t just let you work remotely, but also helps you live a more deliberate, low-impact life. Let’s find a place where you can build your career while actually being a positive part of your new community.

Choosing the right spot is a huge decision. And it’s about so much more than a cheap cost of living. It’s about finding a place that just clicks with your values. The great news? With over 40 countries now offering these permits, your options are better than ever.

Portugal: A Gateway to Rail-First Europe

Portugal has become a massive hub for nomads, and it’s easy to see why. Its D8 Digital Nomad Visa is one of the most well-oiled machines out there. It offers a clear route for remote workers to settle into a country famous for its incredible coastline, old-world cities, and genuinely warm culture. But for an eco-nomad, the real prize is this: Portugal is the perfect launchpad for exploring Europe by train.

To get your foot in the door, you’ll need to show you have a steady remote income of around €3,040 per month. That’s about $3,250 USD. This proves you can support yourself comfortably without taking a local job. The visa starts with a one-year validity. Then, it can be renewed for up to five years. This opens up a real possibility for permanent residency and even a passport down the line.

The process usually kicks off at a Portuguese consulate in your home country. You’ll gather the usual suspects: proof of income, your passport, and health insurance that covers you in Portugal. Once you’re approved and ready to fly, a pre-booked airport transfer from a service like Welcome Pickups can make that first day feel a lot less chaotic.

Spain: Culture, Connectivity, and Tax Benefits

Spain’s Visado para teletrabajadores (Remote Worker Visa) shot to the top of everyone’s list almost overnight. Launched as part of the country’s “Startup Act,” it was built from the ground up to attract international talent with some seriously competitive perks. The relatively low income requirement and incredible tax breaks are a huge draw for anyone considering digital nomad visas.

You’ll need to prove a monthly income of at least €2,762. This works out to roughly $2,950 USD. But here’s the game-changer: the special tax regime, nicknamed the “Beckham Law.” If you qualify, you could pay a flat tax rate of just 24% on your Spanish income. You might also pay a beautiful 0% tax on your foreign earnings for up to five years. For many nomads, that means saving thousands.

Spain’s high-speed rail network is world-class. Therefore, it’s an absolute dream for sustainable travel. You can easily set up a base in a walkable city like Valencia or Seville. Then, you can explore the entire Iberian Peninsula—and beyond—without ever needing to get on a plane. For a deep dive into how Spain’s program stacks up, you can discover more insights about the Digital Nomad Visa Index, which ranks different country offerings.

Croatia: Mediterranean Living with a Modern Twist

Croatia gives you that perfect mix of sun-drenched Adriatic coastline, ancient Roman history, and a modern, forward-thinking vibe. Its digital nomad residence permit lets you live and work in the country for up to a year. This gives you a proper chance to sink into the Mediterranean rhythm of life.

The income bar is set at a very reasonable $2,658 USD per month. A huge plus with the Croatian permit is that you are not liable for local income tax on any of your foreign income. This makes it a financially smart move for anyone looking to maximize their earnings while enjoying an incredible quality of life.

From a low-impact travel perspective, Croatia’s vast ferry network and reliable bus system make it easy to hop between its thousands of islands and sleepy coastal towns. Cities like Split and Zadar are incredibly walkable, letting you live like a local from day one. Just remember to get solid travel medical insurance from a provider like VisitorsCoverage before you apply—it’s a must-have for the permit.

Costa Rica: Pura Vida and Environmental Leadership

For nomads who feel more at home in nature, Costa Rica is in a league of its own. The country’s “Pura Vida” (pure life) mantra isn’t just a tourism slogan; it’s baked into the culture. Its digital nomad visa is perfect for remote workers who want to blend a productive work life with genuine adventure. Plus, it’s in a nation that’s a world leader in conservation.

To qualify, you need to show a stable income of $3,000 USD per month for a single person. For a family, this increases to $4,000 USD. One of the biggest perks? Costa Rica does not tax any income you earn from foreign sources. The visa is granted for one year and is renewable for one more. This gives you plenty of time to explore its cloud forests, volcanoes, and untouched beaches.

The application is handled online, which makes it one of the most straightforward processes out there. Living in Costa Rica offers a rare chance to be in a place where your personal values around sustainability are reflected in national policy. To start mapping out your adventure, you can compare flight options on Aviasales and grab an eSIM from Airalo to make sure you’re connected the moment you land.

Editor’s Pick: Portugal’s D8 Visa

For the eco-conscious digital nomad focused on a rail-first European lifestyle, Portugal’s D8 visa stands out. Its reasonable income requirement, combined with a clear path to long-term residency, makes it a practical and strategic choice. More importantly, basing yourself in Lisbon or Porto puts you at the heart of an expanding rail network, allowing for low-carbon travel across Spain, France, and beyond. This visa isn’t just a permit; it’s a key to unlocking a more sustainable way to live and explore Europe.

Comparing Your Top Digital Nomad Visas

Picking the right visa really comes down to your personal priorities. What’s perfect for a solo freelancer might not work for a remote employee with a family. I’ve put together this table to help you see our top contenders side-by-side. For even more detail, don’t miss our complete guide on where to apply for eco-nomad visas.

Comparing Top Digital Nomad Visa Programs

A quick look at leading digital nomad visas, highlighting what matters most for remote workers who want to travel sustainably.

| Country | Minimum Monthly Income (USD) | Visa Duration | Key Benefits for Eco-Nomads |

|---|---|---|---|

| Portugal | ~$3,250 | 1 year, renewable up to 5 years | Excellent rail connections for exploring Europe; strong focus on renewable energy. |

| Spain | ~$2,950 | 1 year, renewable up to 5 years | World-class high-speed train network; highly walkable cities and great public transit. |

| Croatia | ~$2,658 | Up to 1 year | No local income tax on foreign earnings; extensive ferry system for island hopping. |

| Costa Rica | $3,000 | 1 year, renewable for 1 more year | Zero tax on foreign income; global leader in ecotourism and conservation efforts. |

This table makes the trade-offs pretty clear. Spain and Portugal are no-brainers if your dream is to crisscross Europe by train. On the flip side, Croatia and Costa Rica offer incredible tax breaks alongside stunning natural landscapes. Your best bet will be the one that aligns with both your bank account and your sustainable travel goals.

How to Navigate the Application Process

The idea of tackling visa paperwork for digital nomad visas can feel like a mountain of bureaucracy. But it’s much more manageable when you break it down into a simple checklist. Think of it less as a hurdle and more as a project with a clear finish line.

Most countries are really just looking for the same core information. So, once you gather your documents for one application, you’re well-prepared for the next.

Essentially, governments want to see three things: that you are who you say you are, that you can support yourself without taking a local job, and that you’re in good health. It’s a straightforward process of proving your stability. We’ll walk through the common documents, step by step, to turn this task into a simple to-do list.

Assembling Your Core Documents

Nearly every digital nomad visa application hinges on the same handful of documents. Your first move should be to create a digital folder and start collecting these items. Having everything scanned and ready will make any online submission process incredibly smooth.

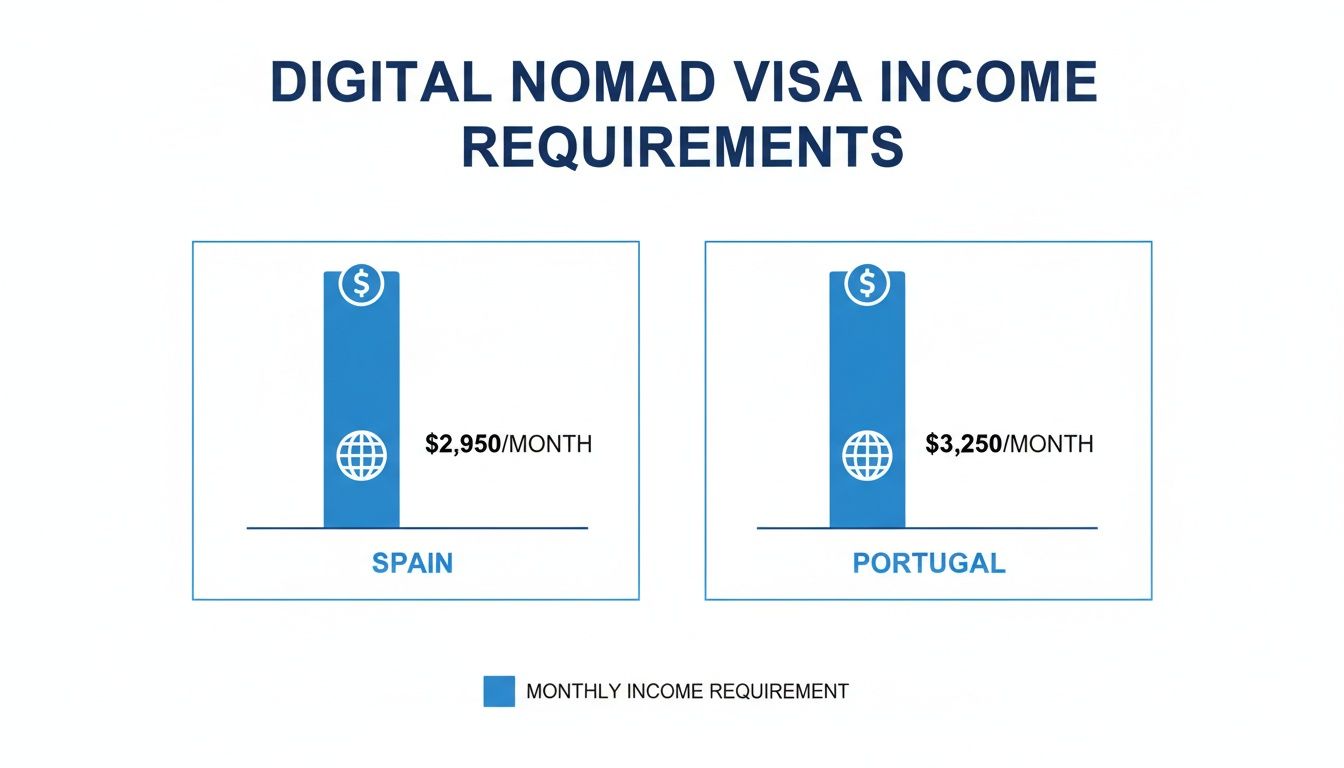

Here’s a quick look at the typical income requirements for two of Europe’s most popular nomad hubs.

As you can see, Spain’s visa requires a monthly income of around $2,950 USD, while Portugal’s threshold is a bit higher at roughly $3,250 USD per month.

You will almost certainly need the following for any application:

- Valid Passport: Make sure it has at least six months of validity beyond your intended stay. Also, check for several blank pages for stamps.

- Proof of Remote Work: This could be a letter from your employer on company letterhead. Or, it could be a collection of contracts from your freelance clients.

- Proof of Income: Bank statements from the last three to six months are the gold standard for showing you meet the financial threshold.

- Clean Criminal Record Check: You’ll need to get this from the national police authority in your home country. It can take time, so start this early.

- Comprehensive Health Insurance: This is non-negotiable. Your policy must provide full coverage in your destination country for the entire visa period.

Securing the Right Health Insurance

Finding the right insurance is a critical step that many nomads leave until the last minute. The policy must meet the specific requirements of the country you’re applying to. This often includes coverage for hospitalization, emergency medical care, and repatriation. Don’t just buy the cheapest plan you can find.

Services like VisitorsCoverage are genuinely helpful. They let you filter plans based on your destination and visa requirements. This ensures you get a compliant policy without the guesswork.

Pro Tips for a Strong Application

Once your documents are in order, a few extra touches can make your application stand out from the pile.

Craft a brief but compelling cover letter. Explain why you’ve chosen their country. Mention your commitment to respecting local laws. And give a quick, professional summary of your remote work.

Finally, double-check every single form for accuracy before you hit submit. A simple typo can cause frustrating delays. For a deeper look into specific country requirements, check out our guide to the best eco-friendly bases for digital nomad visas in 2025.

Making Sense of Taxes and Residency

Let’s talk about the one topic that tends to make even seasoned travelers nervous: taxes. It’s often the most confusing part of planning a nomadic life. But getting your head around a few key ideas makes the whole thing feel much less intimidating. It all starts with a simple concept called tax residency.

Think of tax residency as your financial “home base.” It’s the country that gets the first shot at taxing your income. For most people, this is just the country where they live and work. Simple enough. But when you start spending long stretches of time abroad, the lines can get blurry.

Most countries use a surprisingly straightforward test to figure out if you belong to them for tax purposes. It’s widely known as the 183-day rule. If you spend more than 183 days (roughly six months) in a single country within a year, they will likely consider you a tax resident. This means they’ll expect you to pay taxes on your income. That’s true even if that income came from clients or an employer thousands of miles away.

The Impact on Your Wallet

Getting this right is crucial because it directly affects your bottom line. Becoming a tax resident in a new country can suddenly expose you to tax obligations you never had before. The good news? Countries with digital nomad visas know this is a hurdle. Many have created special rules to make life easier for remote workers.

Some nations roll out the red carpet with incredibly attractive tax incentives. For example:

- Costa Rica: Offers a complete exemption. That means you pay zero local income tax on all your foreign-earned income.

- Croatia: Provides a similar deal, letting you keep 100% of your remote earnings without handing any of it over to the local tax authorities.

- Spain: Has the famous “Beckham Law,” a special tax regime. Eligible nomads might pay a flat rate of 24% on Spanish-sourced income and 0% on foreign income for up to five years.

These programs are specifically designed to attract talent. They do this by making the financial side of things as painless as possible. You can explore more options in our guide to the best places in Europe to live as a remote worker.

Don’t Forget About Home

Even with these fantastic benefits, you can’t completely forget about your home country’s tax laws. For citizens of countries like the United States, your tax obligations follow you no matter where you are in the world. This means you still have to file a U.S. tax return every year. This applies even if you end up owing nothing thanks to tax treaties and foreign tax credits.

Important Note: This information is for educational purposes and should not be considered legal or financial advice. Tax situations are highly individual, and the rules change frequently.

Given how much is at stake, talking to a tax professional who specializes in expat or nomad tax issues is a very smart investment. They can help you make sense of your specific situation. They can also help you take full advantage of tax treaties between countries and make sure you’re staying compliant everywhere. Getting this sorted gives you the peace of mind to focus on the adventure, not the paperwork.

Embracing a Sustainable Nomad Lifestyle

Getting your digital nomad visa is the legal key. It is the official piece of paper that unlocks the door to a new country. But the real journey, the part that actually shapes your experience, starts the moment you step across the threshold. This is your chance to go beyond being just another temporary visitor. Instead, you can build a thoughtful, low-impact life that genuinely adds something to your new home.

It comes down to small, deliberate choices made day after day. Choose a home base where walking is the default. Build your routine around the tram or metro. When you want to explore beyond the city, take the train instead of jumping on another flight. Over time, these habits create a steady rhythm that lowers your environmental footprint, even while you’re simply settling into a long-term rental.

The whole point is to turn the legal privilege of a long-stay visa into a practical tool. A tool for a slower, more meaningful way of living. When you embrace this mindset, you don’t just cut down on your flight emissions. You also gain a much richer, more authentic feel for the place you’re in.

Choosing a Low-Impact Base City

Your choice of a home base has the single biggest impact on your day-to-day sustainability. I always look for cities with world-class public transportation systems. Think Lisbon’s efficient metro or Valencia’s extensive bus network. A city built for people, not just cars, lets you live a healthier, more connected life. And you can do it without ever needing to own a vehicle.

Drill down to the neighborhood level. Prioritize spots where you can walk to the grocery store, local cafés, and a bit of green space. This one simple decision—choosing a walkable community—drastically cuts your reliance on carbon-heavy transport. It also helps you sync up with the local rhythm almost instantly. You can explore more ideas in our guide on green travel for digital nomads in 2025.

Connecting with the Local Community

True sustainability isn’t just about the environment. It’s about weaving positive social and economic threads into the fabric of your new community. Making the effort to learn even a handful of phrases in the local language is huge. It opens countless doors and shows a level of respect that people really appreciate.

Make it a habit to support the little guys. Support the small, locally-owned businesses instead of the big international chains. Shop at the neighborhood market. Eat at the family-run restaurants. And buy souvenirs from local artisans. Your money has a much more direct and positive impact when it stays within the community you’ve chosen to call home for a while.

This approach does more than just enrich your own experience. It ensures that your presence is a benefit, not a burden, to the place you’re living. It’s the difference between simply occupying a space and truly belonging to it.

Your Digital Nomad Visa Questions Answered

Even after wading through all the details, you’re bound to have a few practical questions pop up. It’s completely normal. This last section is here to give you straightforward answers to the most common queries we hear from nomads in the planning stage.

Think of this as the final piece of the puzzle. These are the little details that will give you the confidence to move forward.

Can I Bring My Family on a Digital Nomad Visa?

Yes, absolutely. Many countries have built their digital nomad visa programs with families in mind. Places like Spain, Portugal, and Croatia make it clear that the main applicant can bring along a spouse and dependent children.

The main catch is proving you can support everyone financially. The minimum income requirement will almost always increase for each person you add. For instance, a country might ask for an extra $500 to $1,000 USD per month for your partner. They might ask for a slightly smaller amount for each child.

What Is a Realistic Application Timeline?

Patience is a virtue here, as the timeline can really vary. A safe bet for the whole process is anywhere from three to six months. This covers everything from gathering your first document to getting that visa stamped in your passport.

Certain steps just take time. Getting an official criminal background check from your home country, for example, can easily take several weeks. In the same way, just getting an appointment at the consulate can create delays. The best advice is to start collecting all your documents long before you actually hope to travel.

Do I Really Need to Hire a Lawyer?

For most digital nomad visa applications, hiring a lawyer is not strictly necessary. The majority of these programs lay out their requirements clearly. If you’re a detail-oriented person, you can definitely navigate the process on your own.

That said, a good lawyer can be a lifesaver if your situation is a bit complicated. Maybe you have a previous visa denial. Or perhaps your income comes from a bunch of different sources. They’re also incredibly helpful if you’re applying in a country where you don’t speak the language. Ultimately, it’s a personal choice. It comes down to trading cost for convenience and a little extra peace of mind.

Key Takeaways

- Income is Key: Every digital nomad visa requires proof of stable monthly income, usually somewhere between $2,500 to $3,500 USD.

- Tax Benefits Vary: Places like Costa Rica and Croatia offer zero tax on foreign income, while Spain has a special reduced rate. These are financially powerful perks.

- Sustainability Matters: A country with great public transit and rail networks, like Spain or Portugal, can dramatically lower your carbon footprint.

- Long-Term Potential: Many visas, especially in Portugal and Spain, can be renewed and eventually open the door to permanent residency.

- Insurance is Non-Negotiable: You’ll need proof of comprehensive health insurance that’s valid in your new home country for any application.

- Connectivity is Crucial: Have a plan to get online the second you land. An international eSIM from providers like Yesim is a lifesaver.

Join the Sustainable Work Movement

Want more rail-first itineraries, low-impact packing systems, and walkable base-city ideas?

Digital Nomad Visas FAQ

Quick, practical answers to the questions people ask most when planning digital nomad visas.

Eligibility & Requirements

+1) What are digital nomad visas, in plain English?

Digital nomad visas are long-stay permits that let you live in a country while working remotely for clients or an employer outside that country. They’re designed to bridge the gap between tourist visas (no work) and local work permits (local job).

+2) Who qualifies for digital nomad visas?

Most programs are open to remote employees, freelancers, and business owners who can prove stable income from outside the host country, maintain valid health insurance, and pass a background check. Some countries also require a minimum time with your employer or clients.

+3) What documents do I usually need for digital nomad visas?

Common requirements include a valid passport, proof of remote work (employer letter/contract or client contracts/invoices), recent bank statements (often 3–6 months), health insurance coverage for the full stay, and a clean criminal record check. Some countries also require apostilles and certified translations.

+4) How strict are the income requirements?

Income thresholds vary by country, but most want to see consistent monthly earnings that meet or exceed their minimum. If your income fluctuates, strong bank statements, long-term contracts, and a clear paper trail can help strengthen your application.

Application Process

+5) Can I apply while I’m already in the country?

Sometimes. A few countries allow in-country applications, while others require you to apply at a consulate from your home country (or country of legal residency). Always confirm the rule for your specific destination before you book long stays.

+6) How long does it take to get approved?

Processing times vary widely—from a few weeks to several months—depending on the country, the season, and the workload at the consulate. A realistic planning window is 3–6 months to gather documents and receive a decision.

Tip: Avoid non-refundable bookings until you have written approval.

+7) Do I need a lawyer to apply for digital nomad visas?

Usually not. Many applicants succeed by following the checklist carefully. A lawyer can be helpful if you have complex income sources, prior visa issues, language barriers, or you’re applying with dependents and want added certainty.

Family, Insurance & Day-to-Day Life

+8) Can I bring my family on digital nomad visas?

Often yes. Many countries allow spouses and dependent children, but the income requirement typically increases with each dependent. You may also need extra insurance coverage and additional documents (marriage/birth certificates).

+9) What kind of health insurance is required?

Most programs require comprehensive medical coverage valid in the host country for the full visa period. Some require minimum coverage limits and benefits like hospitalization and repatriation. Make sure your policy certificate clearly states the destination and coverage dates.

+10) How do digital nomad visas affect taxes?

Tax rules depend on where you become a tax resident—often influenced by the 183-day rule—and on specific visa tax regimes (if any). Because the details vary by citizenship and destination, talk to a qualified expat tax professional before you commit to a long stay.

Note: This is educational information, not legal or financial advice.

+11) Are digital nomad visas good for sustainable travel?

Yes. Staying longer in one place reduces frequent flights, supports local businesses through everyday spending, and makes it easier to live car-free in walkable neighborhoods. Choosing rail-connected base cities can lower your travel footprint even further.

+12) What’s the biggest mistake people make with digital nomad visas?

Rushing. The most common problems come from missing documents, outdated background checks, incorrect translations, and booking non-refundable travel too early. Build a timeline, keep a document folder, and triple-check the consulate checklist.